Roblox, the perfect litmus test on what it takes to run a metaverse

Running a metaverse takes continuous corporation engagement, investment, and control.

Metaverse this and metaverse that. NFT this and NFT that. Towards the end of 2021 these were the two buzzwords that had the video game market all-a spin. They are words that capture a possible future where video game worlds are interconnected, from which gamers could transition “investment of time” into money by engaging in the metaverse and selling content.

Roblox is the closest approximation we have today regarding the metaverse future

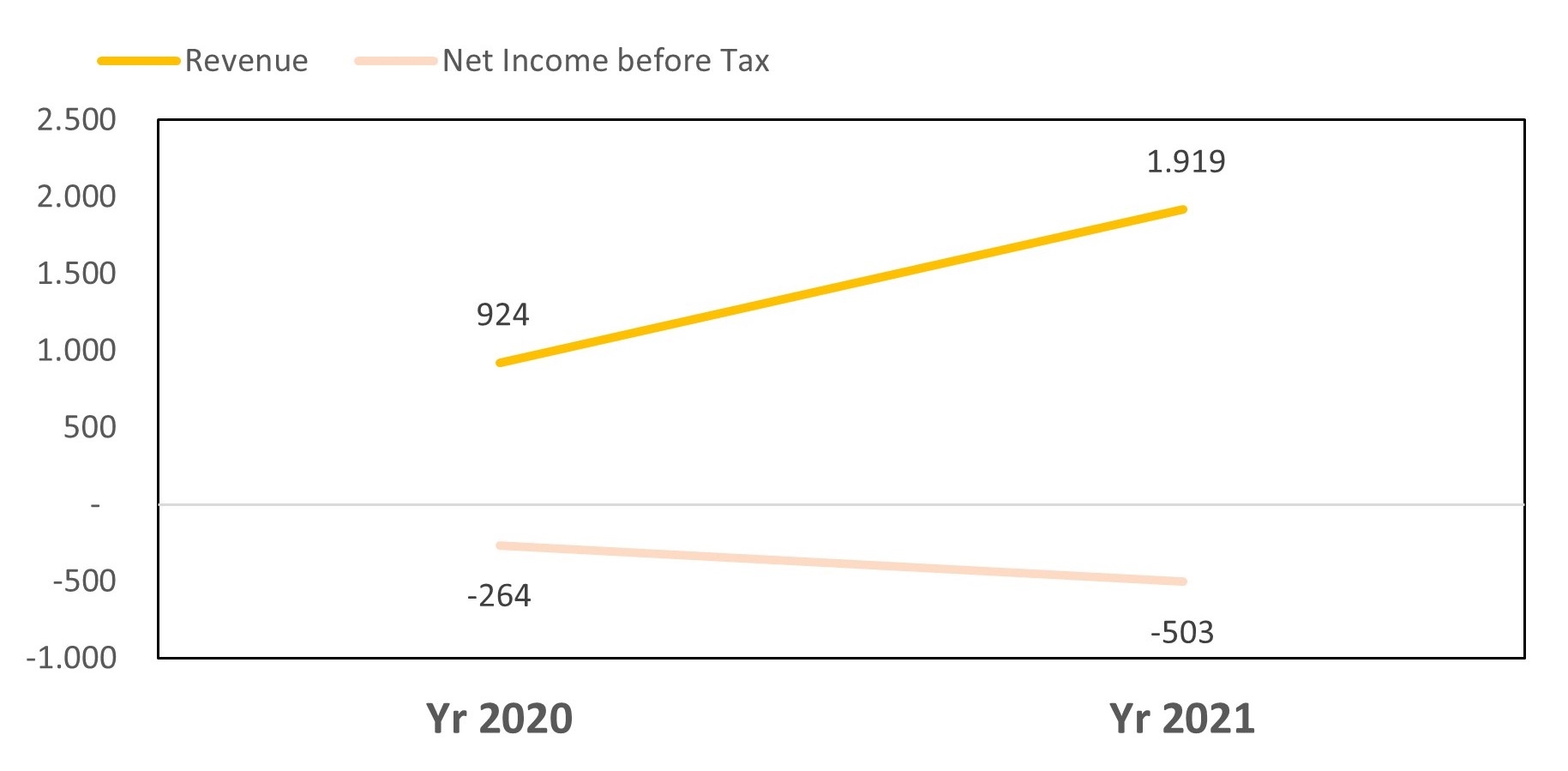

In their 2021 financial results , it is possible to gauge just how popular and prosperous this community-led platform has become. The numbers speak for themselves. In just 20 years the company went from a foundling start-up to a publicly traded company, raising $38 billion. Today its annual revenue is just shy of $2 billion, a growth rate of over 100%. But here lies two problems. That growth has not come without a price. That price is growing expenses and a reliance on expanding net bookings (future revenue). Roblox is currently trading at a net income loss and this loss increased in line with the growth rate of its top line revenue. So, although Roblox doubled its income between its fiscal years 2020 and 2021, it also doubled its net income loss to just under half a billion dollars.

The chart below illustrates the diverging directions between gross and net income.

Roblox Fiscal Annual Income

Source: Roblox Investor Relations

The losses are derived from increasing cost of running servers, R&D and paying royalties to its content creators that feed the growth in daily active users. A juxtaposition between expanding gross income and increasing negative net income resulted with a dissatisfied class of investors who expected, or demanded more.

This has resulted with Roblox in the unenviable position of expanding rapidly while simultaneously making investors unhappy. So, what is going wrong?

Almost all video game companies in 2021 saw a rebalancing of their revenue growth as gamers spent money elsewhere given the pandemic receded and lockdowns lifted. That reality check should have been factored in when looking at video-game content sold in the West. Roblox’s bookings were lower than expected. The average bookings per daily active user fell 10% year over year in Q4’21, marking the third consecutive quarter of decelerating growth. Fewer bookings spell declining consumer engagement but more importantly, declining future top line revenue. It is difficult to see how Roblox can turn this situation around. To appeal to new customers, Roblox will either need to shell out more money on royalties or more money on R&D, marketing or game creation tools and mechanics.

To add to the woes, the Roblox platform has come under major scrutiny over its low royalties’ payments, exploitation of creators, and evidence of sexual misconduct in the Roblox universe. The latter is particularly worrying because in the BBC’s investigation into sexual malice in Roblox’s platform found that “two-thirds of all US children between the ages of nine and 12, use the game”. Roblox’s main consumer category is children, so the company will need to heavily regulate user behavior (especially from adults and teenagers) while at the same time allowing its player base the freedom to explore the metaverse.

Control vs freedom

This dichotomy between “company control” and “user freedom” is not lost when surveys were conducted about the popularity of the metaverse and especially NFTs. There has been a wave of negative feedback in the video game community, as well as from Ubisoft staff, over the launch of Ubisoft’s Quartz blockchain initiative to sell NFTs. The model was launched under the banner that the community could buy pre-made NFT DLC for the game Tom Clancy’s Breakpoint with the view that consumer generated NFTs could be sold one day in the future. The problem was that no one wanted them. Cent, one of the main trading markets for NFTs, temporarily ceased trading due to the high level of corruption in the NFT marketplace. Selling NFTs to a reluctant consumer base is becoming a tough call. Then there is the added issue of how much corporate control is required in the metaverse to keep it functional.

The problem is that advocates of the blockchain are now beginning to bulk at the idea the metaverse should be controlled.

This is from the website Techyno.com “In a survey commissioned by nonfungible token and metaverse infrastructure provider Advokate Group, 87% of respondents preferred a decentralized metaverse on a blockchain over some of the mega projects planned by tech giants. This became more evident when 77% of the respondents shared concerns over Facebook’s entry into the metaverse, especially since it owns users’ metaverse data.” The promised “freedoms” that come from a metaverse are anything but. This could be worrying for corporations that envision an all-encompassing metaverse future as they will inevitably face numerous problems.

These problems can manifest in numerous ways. For example, how to appeal to the widest audience possible without losing control to prevent abuse or fraud? How to appeal to new audiences when older ones are critical? How to convert players into payers? How to expand the metaverse with new or original content when gamers lose interest but without spending so much money? How to unify with other metaverses? How to generate a positive brand image while keeping control over every aspect of the user experience? How to legally traverse where liability begins and ends inside a metaverse? These are all minefields of management that require constant maintenance.

Unlike selling full-priced games, metaverses need continuous investment and engagement. Live-service games such as PUBG, Rocket League, Apex Legends and Destiny 2 proved that without new content, players disengage and move on. So, while metaverses may generate billions in revenue, it looks like they will need as many billions of dollars in investment and continuous management just to keep the universe alive and relevant. Some publishers may seriously question – is it worth it?